Understanding the Battery supply chain, and why you should care

New Energy Weekly Wrap – Aug 5, 2022

Hi friends – Following the weekly new energy market summary, this week we will dive into the battery supply chain, its key stages and why one should care.

New Energy Market Summary

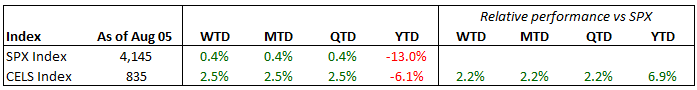

Last week, the clean energy sector continued to outperform the broader market driven by the increasing likelihood of the passage of the Inflation Reduction Act (IRA). For the week ended Aug 5, the NASDAQ Clean Edge Green Energy Index (CELS) rose 2.5% w-o-w, compared to the 0.4% gain on the S&P 500. YTD, CELS is down 6.1%, outperforming the 13.0% loss on the S&P 500.

US Democrat Senator Kyrsten Sinema, who was the last holdout for the IRA reached a deal on Thursday allowing the bill to move forward. Subsequently, the US Senate on Sunday approved the legislation, which will next go to the House of Representatives for a vote and then to the White House for the president to sign into law. The IRA reshapes and expands tax incentives for a broad range of renewable energy resources. In a nod to today’s battery supply chain topic, the bill includes a first-of-its-kind investment tax credit for standalone storage projects (similar to solar and wind previously) as well as an assortment of tax credits for battery manufacturing in the US.

Within CELS, last week’s best performer was Romeo Power Inc. $RMO with a 62% gain. $RMO and Nikola Corporation ($NKLA) announced on Monday, August 1 that $NKLA has agreed to acquire $RMO in an all-stock transaction that values $RMO at $0.74/share, representing ~34% premium to $RMO’s closing price on July 29. The total equity consideration for $RMO of $144mn is still ~84% lower than its 52-week high of $905mn. $RMO is an energy storage technology company focused on designing and manufacturing of lithium-ion battery modules and packs for commercial vehicle applications. Notably, $NKLA was also $RMO’s largest customer.

The week’s laggard was American Superconductor Corp $AMSC with a 15% loss after its FY1Q22 revenue and EPS missed consensus estimates. $AMSC sells electric control systems, generators and drivetrains, power converters, and utility voltage solutions as well as other related products globally.

Now on to today’s focus topic…

Understanding the Battery supply chain, and why you should care

The battery supply chain is extensive and fascinating, primed for breakthroughs and rapid growth, and brimming with massive investment opportunities. Batteries, in particular the lithium-ion rechargeable batteries, are one of today’s key energy storage technologies, and arguably, the most commercially deployable one for electric power storage. In this post, we will discuss the key stages of lithium-ion battery supply chain – but first, a small detour to discuss why one should care. (While advances in other forms of storage such as mechanical and thermal are still underway and could play meaningful role in decarbonization, they are out of scope in this post.)

Why should you care?

In the words of Elon Musk, the three parts of sustainable energy future are: (1) sustainable energy generation, (2) storage, and (3) electric vehicles. Battery storage is central to the latter two parts, and today, has become the ultimate bottleneck and the biggest impediment for accelerated electrification and decarbonization of power and transportation sectors.

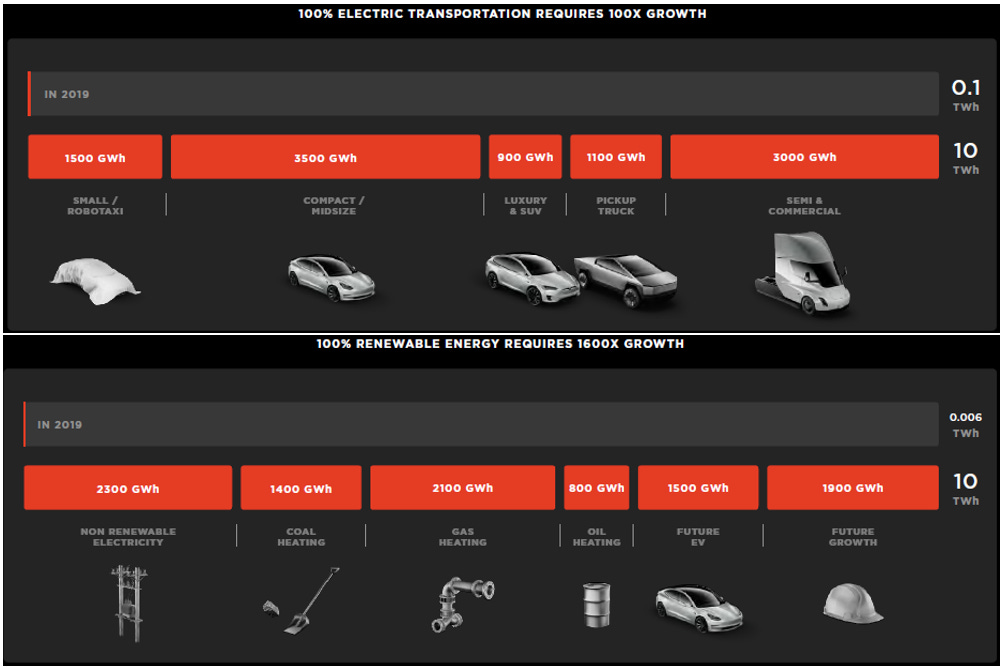

At its Battery Day presentation in September, 2020, Tesla noted that the world needs 100 times growth in battery production for EVs (from 2019 level) to 10 TWh of annual capacity to meet 100% electric transportation, and a 1,600 times growth for grid batteries (from 2019 level) to 10TWh of annual capacity to meet 100% grid electrification with renewable energy.

Source: Tesla Battery Day Presentation

A recent NREL study suggested that in a 2050 zero carbon scenario (100% carbon-free electricity), 932 GW of grid storage capacity lasting for 6.5 hours (~6 TWh) will be needed to cover electricity demand in the US. This would be ~1,300 times greater than the 4.6 GWh of operational utility scale battery storage capacity deployed at the end of 2020, per EIA.

These are incredible growth numbers that are hard to fathom. Considering the battery supply chain is already constrained today at almost all stages, the challenge of adding the necessary capacity and meeting the world’s climate targets seem almost insurmountable. While the problem appears herculean, it also presents a world of opportunities to invest, grow and create an enduring climate wealth while taking on decarbonization.

Who should care and why?

Governments and policymakers need to appreciate the current constraints on production of component metals including rare ones, onerous permitting requirements as well as geographical concentration of the supply chain in certain parts of the world, often undesirable, which makes the battery supply chain a matter of national security.

Investors should view the entire battery supply chain as a goldmine of opportunities. Each stage is still hungry for capital and hosts opportunities (and risks to existing investments) for all types of investors from seed equity to public equity as well as private credit to investment grade.

Wide variety of companies should care for a host of different reasons. Power companies (Electric utilities) need both temporal and locational storage to maintain a stable grid while increasingly integrating intermittent renewables as well as reducing reliance of gas peakers to handle peak demand. Automotive companies need batteries to transition to electric alternatives for two, three and four wheelers as well as long-haul trucking. Any company that uses metals as inputs should be mindful of the demand tsunami that will overwhelm the industrial metal markets. And in the same vein, any company that purchases electricity (which is all!) should care considering electricity will become a higher share of overall energy consumption as the world electrifies. On-premise batteries (with solar) can not only reduce peak demand power prices but also help achieve higher share of renewable electricity.

Ultimately, end consumers should care because we are about to encounter a battery revolution, which firstly, will make this technology omnipresent in our daily lives beyond occasionally getting reminded about its importance when charging cellphones; and secondly, will bring about a geopolitical battlefront for all resources that supply into the battery supply chain.

The Battery Supply Chain

We visualize the battery supply chain segmented in stages across four sectors:

Upstream: Metals & Mining

Midstream/Production: Battery manufacturing

Downstream: EVs and Grid storage

End of life: Recycling

In the section that follows, we’ll dive into these sectors in three parts:

Brief introduction

Key features of the stage – we’ll use Porter’s five forces as a framework

Top companies

Upstream: Metals & Mining

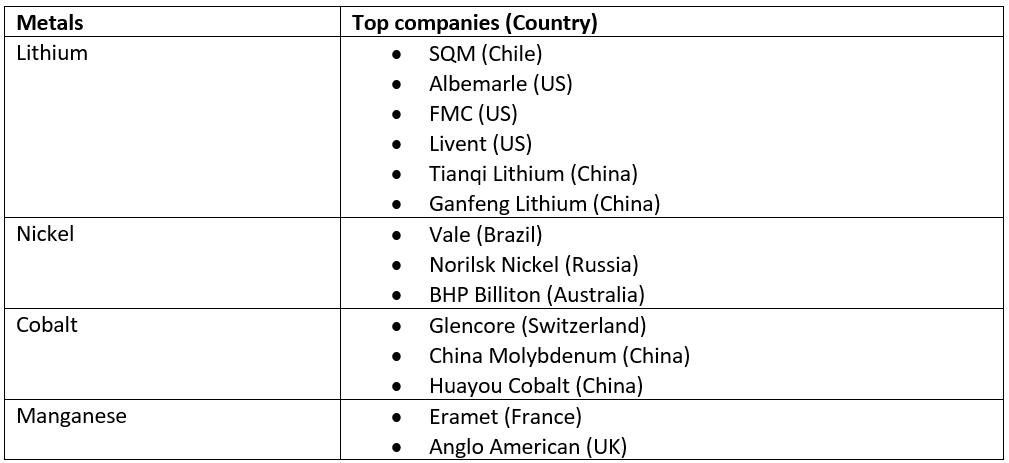

A typical lithium-ion battery uses lithium ion to transfer electric charge between the cathode and the anode. While the anode is mostly made of graphite, the cathode is composed of a combination of nickel, cobalt and manganese. Other materials that also form part of the batteries include copper, aluminum and iron. All these materials are produced by mining companies that explore and discover deposits on earth’s crust, build mines, process the materials and supply to battery manufacturers.

Mining companies have explored and produced all these metals for a long time. However, the rise of battery adoption in consumer electronics and EVs has been the key demand driver for lithium, nickel and cobalt. As a result, these metals have faced an explosive growth over the last decade.

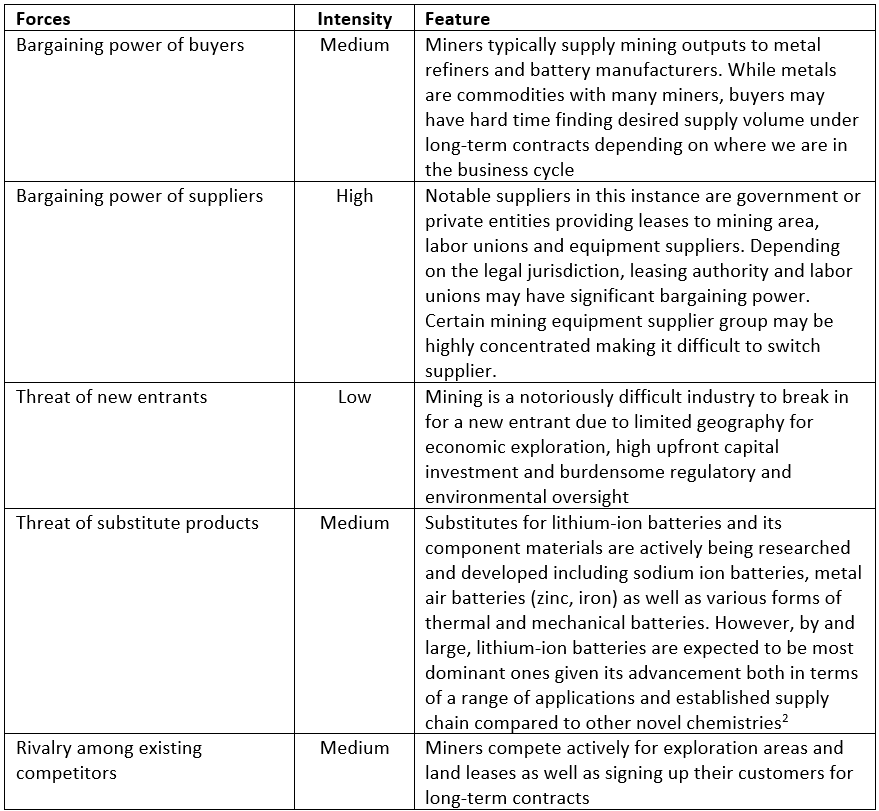

Key features of metals & mining industry

[2]: Sila _ The Future of Energy Storage White Paper

Major mining companies by key metal produced

We’ll pick up on the remaining stages of the Battery Supply chain in a future post…stay tuned!